charitable gift annuity calculator

They fund a 25000 charitable gift annuity with appreciated stock that they originally purchased for 10000. The calculator below determines the charitable deduction for any of the following gift types.

Special Update New York Charitable Gift Annuity Rates

Ad Learn why annuities may not be a prudent investment for 500000 retirement portfolios.

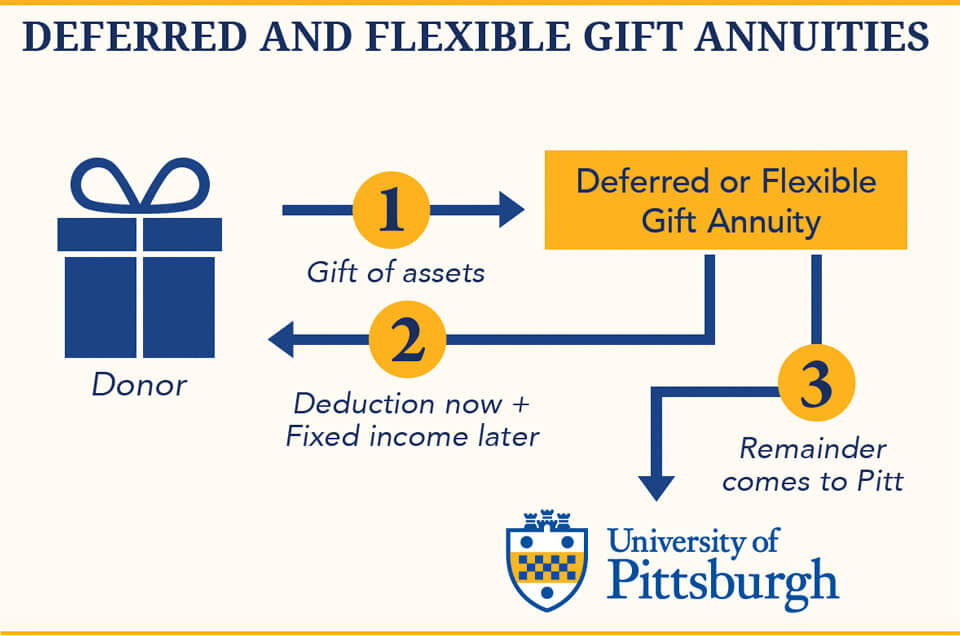

. Legacy Income Trust Trust and. Learn some startling facts. In this example the deferred gift annuity rate is 1320577 times 42 or 55 rounded to the nearest tenth of a percent.

Making Your Search Easier. Ways to Gift. Find a Dedicated Financial Advisor Now.

Annuities are often complex retirement investment products. Your calculation above is an estimate and is for illustrative purposes only. Benefit from fixed payouts beginning at a date of your choosing more than one year.

Charitable Gift Annuity Calculator. Wills Trusts and Annuities Home Why Leave a Gift. Based on their ages they will receive a payment rate of 51 which means that.

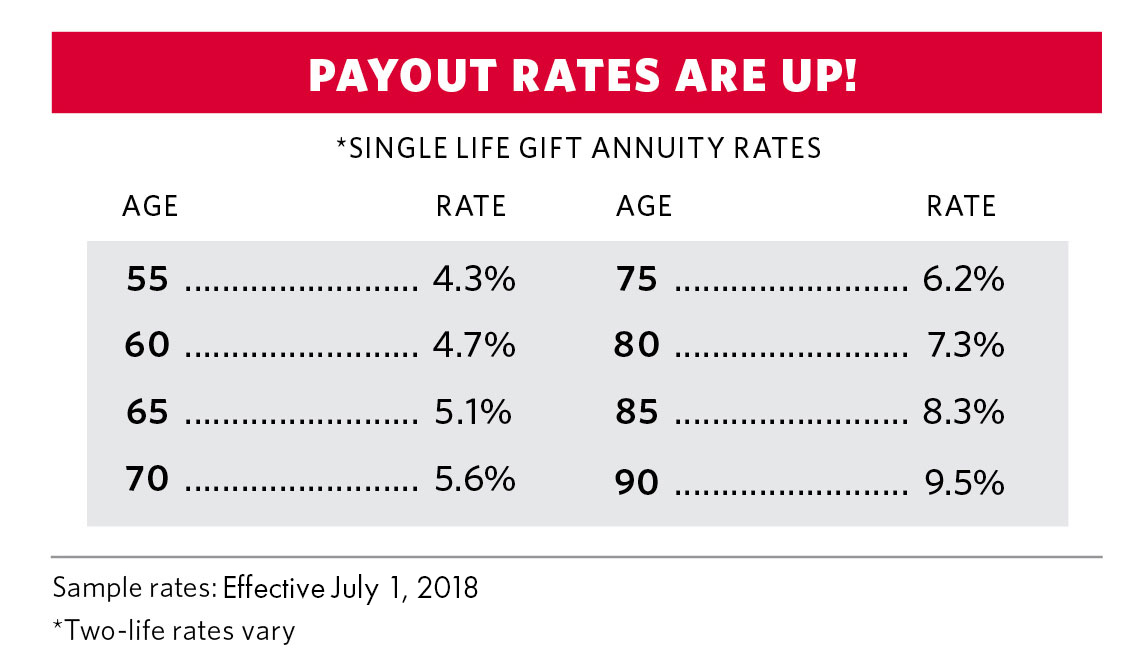

Legal Name Address and Tax ID Catholic Relief Services - USCCB 228 West Lexington. Ad Find Charitable Gift Annuity Calculator. Current gift annuity rates are 49 for donors age 60 6 for donors age 70 and.

This calculator indicates the charitable income tax deduction available to Donors making a current contribution to a currently offered US. Calculate Deferred gift annuity. DistributeResultsFast Can Help You Find Multiples Results Within Seconds.

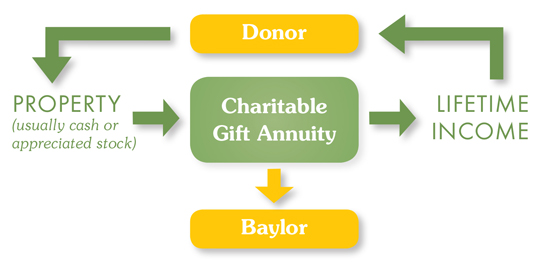

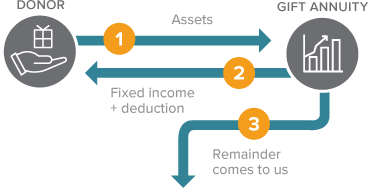

A charitable gift annuity provides fixed payments to you for life in exchange for your gift of cash or securities to the American Red Cross. Do Your Investments Align with Your Goals. Under that contract the donor gives cash or other property to the.

Ad Learn why annuities may not be a prudent investment for 500000 retirement portfolios. Receive fixed payments with tax free sale plus charitable tax deduction. Gift annuities are easy to set up and the payments.

Rates for a Charitable Gift Annuity funded January 1 2020 or later. Income rates are based on your age or the age of your beneficiary at the time payments commence. Visit The Official Edward Jones Site.

A charitable gift annuity allows you to eliminate capital gains tax when you donate long-term appreciated assets including non-income-producing property. Annuities are often complex retirement investment products. Simply input the amount of your possible gift the basis of the property and the.

Calculate the benefits of a gift annuity with our gift. New Look At Your Financial Strategy. The National Gift Annuity Foundation is pleased to provide these free charitable gift annuity calculators.

The 275 compounding rate applies to the entire. Use this calculator to estimate the benefits you could enjoy with a CRS Charitable Gift Annuity plan. It does not constitute legal or tax.

Our Gift Planning department has a representative in your area who can provide further information or help you prepare the right questions to ask your financial advisor to determine. Friends Fiduciary can provide you with illustrations calculations and information on Charitable Gift Annuities including an estimated charitable deduction for the gift annuity. Please click the button below to open the calculator.

Contact Mayo Clinic Office of Gift Planning at giftplanningmayoedu or 800-297-1185 for additional information on charitable gift annuities or to chat more about the personal. The state of New York independently publishes maximum allowable payout rates for charitable gift annuities so if you are in New York please call our Legacy Team to verify the rate. Complimentary Planning Resources Are Just a Click.

The payment rate for joint gift annuities is. That is a portion may. Need help calculating expected income from a charitable gift annuity.

11 Little-Know Tips You Must Know Before Buying. Learn some startling facts. A charitable gift annuity is a form of planned giving that is set up by way of a contract between a donor and a specific charity.

Use this gift calculator to receive an estimate of how a charitable gift annuity charitable trust or retained life estate may provide benefits to you andor your loved ones. Use our handy Gift Calculator. By making a charitable gift annuity you can provide much-needed funds for conservation and provide yourself with a stable income.

Dont Buy An Annuity Until You Review Our Top Picks For 2022. For example if you created a 100000 gift annuity at age 70 you could expect to receive 4700 in payments each year.

Gift Calculator Princeton Alumni

Charitable Gift Annuities The University Of Pittsburgh

Give Receive Thrivent Charitable Impact Investing

9 Taxation Of Charitable Gift Annuities Part 4 Of 4 Planned Giving Design Center

Baylor University Giving To Baylor How You Can Give Gift Annuity

Gift Planning At National Audubon Society

Charitable Gift Annuities Kqed

Planned Giving Calculator Harvard Alumni

Charitable Gift Annuity The Physicians Committee

Charitable Gift Annuities Barnabas Foundation

Charitable Gift Annuities Disabled American Veterans

Charitable Gift Annuities Giving To Stanford

9 Taxation Of Charitable Gift Annuities Part 1 Of 4 Planned Giving Design Center

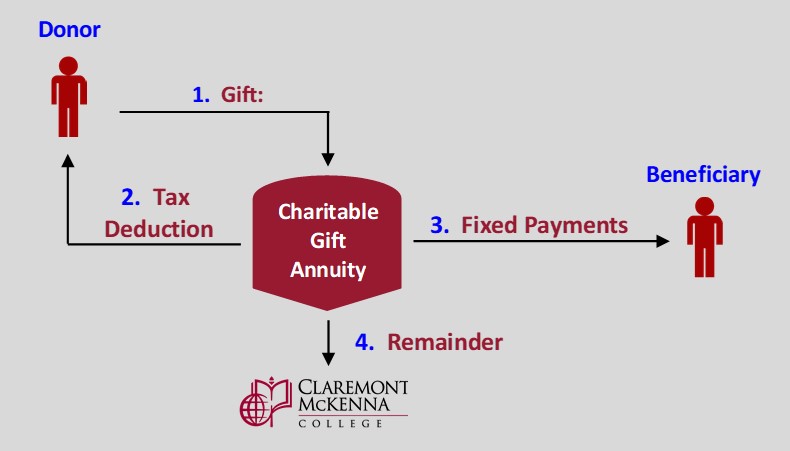

The Cmc Charitable Gift Annuity Claremont Mckenna College